Going, Going, Gone?

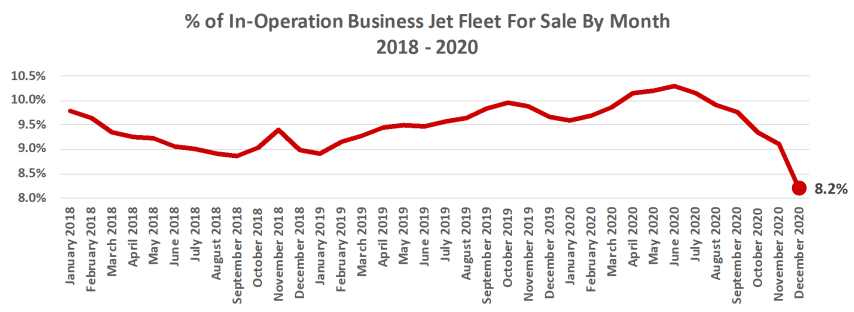

Early indications suggest that inventory has since shrunk even further, to just 1,776 jets on January 11, 2021 or just 7.9% of the fleet.

Pre-owned pricing today is generally in alignment with expectations on both sides of the transactions table compared to May 2009 when for-sale jets peaked near 19% of the in-service fleet, the highest ever recorded.

At 8% in January 2021, inventory as a percentage of the in-service fleet is now at its lowest recorded level to date in this millennium.

Although business jet flights were off YoY from -11% in Light up to -27% in Large most of the reduction in usage was in first half of 2020. Since then flights have recovered almost to normal with the exception of Large aircraft.

It is no surprise Large aircraft remain slow due to the continued pressures and difficulties with International Travel.

- Charter P135 activity has mostly recovered to about 85% of pre-Covid-19 levels, but Business Private Part 91 flying remains stubbornly flat and down 30-40% from 2019 levels with the greatest decline in larger, longer range jets.

- Much of this difference between Private Part 91 flying and Part 135 Charter could be attributed to new entrants into the private flying world that started chartering aircraft more or for the first time in 2020 due to Covid-19.

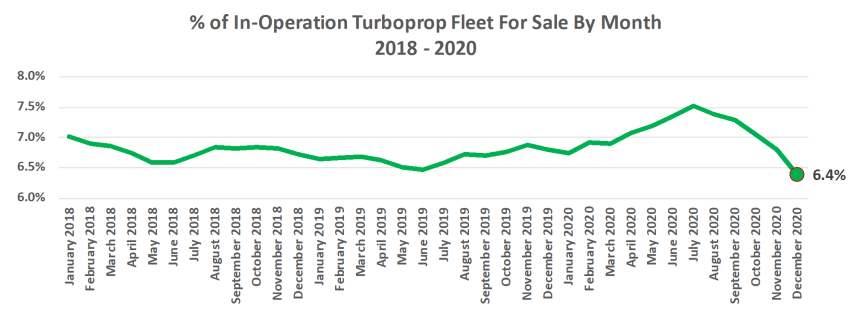

- It is also becoming apparent that many Private flyers opted to purchase their own aircraft as well as represented in the declining available inventories numbers.

JETNET’s proprietary monitor of sentiment amongst aircraft owners / operators rebounded smartly in Q4 2020 across most regions of the world, based on JETNET iQ quarterly surveys.