Will Expiring Depreciation Tax Supercharge Transaction Closings?

MIAMI—A record number of aircraft transactions could occur this year, and given upcoming changes to U.S. depreciation accounting rules, will this put even more of a race to close deals by the year end?

It could, but it depends on a buyer’s risk tolerance level.

The issue at question is the 2017 U.S. tax bill that provides 100% bonus depreciation on certain assets, including aircraft, “but it begins to phase out next year (up to 100% in 2022, 80% in 2023 and 60% in 2024),” says Kent Jackson, Jetlaw’s managing partner.

The same tax bill also eliminates “like kind exchanges, which had been used to avoid recapture of depreciation. Like kind exchanges weren’t necessary while 100% bonus depreciation is available, but as bonus depreciation phases out, there will be tax issues. And no one can fully predict what Congress will do next. Altogether, these factors put pressure on buying aircraft this year, particularly for those who are replacing aircraft,” Jackson says.

For motivated buyers, it’s still possible to close an aircraft transaction this year, but “there is risk involved with it,” especially if buyers proceed with only a visual aircraft inspection or no inspection at all, says Keri Dowling, Air Law Office president, speaking at the Corporate Jet Investors Miami event.

“The fourth quarter is always a horse race and this year is no different. In fact, I’d argue it’s a little accelerated this year because of the changing bonus depreciation,” says Andy Priester, Priester Aviation’s chairman and CEO, speaking at Corporate Jet Investor Miami.

While buyers waved inspections last year around this time, now Dowling says she’s having more “substantive conversions with the entire team of the purchaser about whether they really want to take the bonus depreciation and whether that’s something that really fits into their overall tax planning structure,” Dowling says.

While the depreciation appeals to some, to others they “realize that the bonus depreciation looks really good until you get down to the nitty gritty,” she adds.

Regardless of whether buyers are motivated by the bonus depreciation, expect the rest of this quarter to be busy and MRO slots for pre-buy inspections to be hard to book.

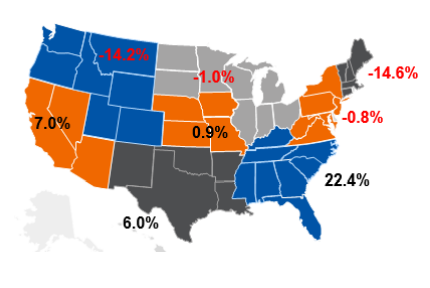

For the first time in three months, business flight activity increased from its previous month in North America. However, business aviation flights in October for North America lagged behind 2021.

For the first time in three months, business flight activity increased from its previous month in North America. However, business aviation flights in October for North America lagged behind 2021.